Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Buying a budget TV maker is not the most obvious way to sell more advertising. But when you are America’s biggest retailer and your share price is riding at a record high, you can afford to make a side bet or two.

Walmart pitched its $2.3bn acquisition of TV maker Vizio last month as a way to scale up its small but fast-growing advertising unit. At the moment, the retail titan mainly sells ads on its websites, apps and self-checkout screens in stores. Buying Vizio would give it more ways to sell ads through Vizio’s TV sets and free video streaming service.

Walmart’s weak M&A record invites scepticism. Ecommerce sites Jet.com, ModCloth, Moosejaw and Bonobos, plus video on demand service Vudu, are past Walmart conquests that have since been sold off or wound down.

But those deals were not total flops. Even if those brands never became an important part of its business, Walmart gained valuable knowhow that helped jump-start its ecommerce operations. More than 15 per cent of its total sales, or $100bn, came from online channels in its past fiscal year, compared with $10bn a decade ago. Vizio could serve the same function as Walmart looks to build out its media and advertising platform to compete with Amazon.

Walmart is paying a hefty 59 times forward earnings for Vizio. It has a good reason to move quickly. While the duopoly of Google and Facebook parent Meta still rules the $270bn US digital advertising market, a window has opened up for traditional retailers to grab some of that market share.

In 2021, Apple and Google both introduced new privacy features that would make it harder for advertisers to harvest data for targeted ads. The decline of third-party cookies left brands with less insight into their ad spending. But it has made first-party data, such as that collected by Walmart on the 255mn customers that visit its stores and websites each week, more valuable.

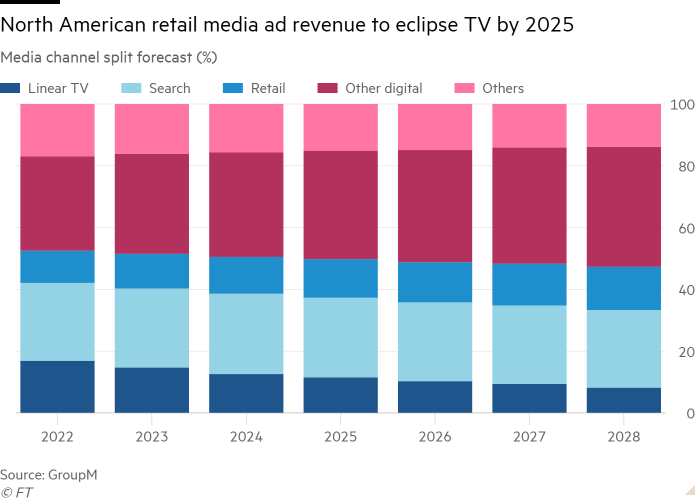

Underscoring the market’s potential growth, a report by GroupM reckons advertising spending on retail media in North America will surpass television revenue by 2025.

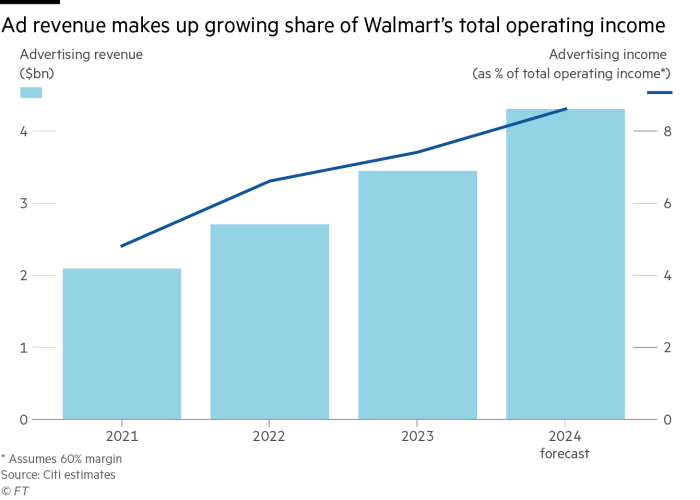

For now, advertising accounts for a small sliver of Walmart’s overall revenue. But it is highly profitable. Analysts at Citi put operating margins at least 60 per cent; they reckon ad sales generated about 7.5 per cent of Walmart’s total operating income last year and could account for 8.6 per cent this year.

Vizio is a small, albeit expensive, acquisition. Its streaming service has about 18.5mn active users and the company made $28mn in net income on $1.68bn of revenue last year. But it shows Walmart is serious about building a rival to Amazon Prime. The pay-off could come if Walmart can successfully use Vizio to build up an entertainment offering for Walmart+ members and convince companies to park more of their ad budget with it.

Lex is the FT’s concise daily investment column. Expert writers in four global financial centres provide informed, timely opinions on capital trends and big businesses. Click to explore