Over the last decade, India has become a key focus for many social apps.

The second most populous nation in the world, India offers reach to more than a billion potential new users in its own right, and its fast evolving digital economy could, and should, provide significant potential for social platforms, especially those that can get in on the ground floor, and establish themselves as the go-to apps.

But at the same time, India’s history of Government intervention and control has limited opportunities for some, while the lower economic status of many Indian citizens means that the overall user numbers don’t hold the same meaning, in a pure revenue sense.

So while many platforms have made the nation a focus, especially in terms of more recent user growth, that growth, while looking great in performance updates, hasn’t led to equivalent business performance.

Which, for some, is now proving problematic. Because while market analysts are happy to see user counts go up, without the expected revenue boosts that come with them, those numbers are somewhat hollow, and won’t pay off for some time yet.

That’s why Snapchat’s now shifting focus away from India, in order to expand on its business opportunities in other nations.

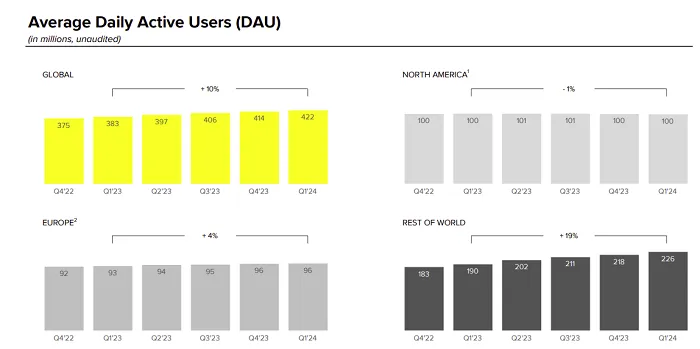

Snapchat has added 39 million more daily active users over the past year, maintaining a solid growth trajectory for the app. But in the U.S., which is its key revenue market by far, it’s actually lost 1% of its daily audience.

So while the main graph looks good, the business impact isn’t so great.

As explained by Snap in its Q4 2023 performance update:

“While we see significant long-term potential for community growth in Rest of World, we are shifting more of our focus toward community growth in our more mature geographies like North America and Europe. Over the past several years, we’ve driven significant growth in DAU by focusing on Android performance in large emerging markets, including India. We will continue to build on our momentum in the APAC region while increasing our investment in improving the product experience for our community in North America and Europe.”

It’s a similar story for Meta, which has seen huge growth in India, particularly with WhatsApp, which is the biggest messaging app in the region.

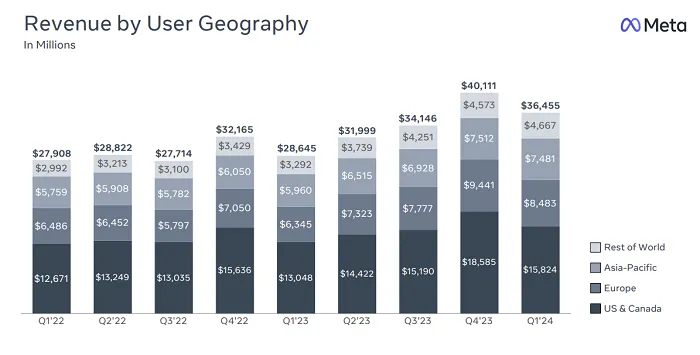

With almost 500 million active WhatsApp users in India, that should present significant revenue potential. But Meta’s performance data shows that the Asia Pacific region, of which WhatsApp is a part, still trails behind the U.S. and Europe in terms of value for the business.

Again, India is a developing market, so it will take time to mature in this respect, and WhatsApp is not as easy for Meta to monetize, given that it’s a private messaging app.

But the data highlights again why the pure numbers of Indian users are still only reflective of potential, and each platform will need to spend considerable time and resources to capitalize on that, sometime in future.

Which, for some, may actually be too far ahead to even consider.

At the same time, the Indian Government is continuing to pressure social platforms to abide by increasingly restrictive and intrusive rules, in order to maintain their operations in the nation.

Meta, for example, is currently in a battle with the Indian Government over the future of WhatsApp, after Indian authorities implemented new rules that essentially ban encryption in social and/or messaging apps.

Under India’s revised Information Technology rules, all social platforms and messaging services need to maintain a log of information about users and their activity, in order to enable local authorities to trace originators of content if they need.

That, Meta told the Delhi High Court last week, would break encryption on WhatsApp, which would mean that it would need to pull the messaging app out of the Indian market entirely. Indian authorities are still pushing for the change, but the options presented thus far could indeed see Meta scaling back its Indian presence, unless the rules are changed.

X (formerly Twitter) has also been forced to bow to requests from Indian officials to remove content, in order to quell negative sentiment about the government. In most cases X (and Twitter before it), has complied with these demands, but it continues to challenge some that overstep the law in the region.

The risk here is that by abiding by Indian Government pushes in this respect, social platforms are then providing a means to censor certain speech, in line with the government of the day, while challenging such could lead to further restrictions in the region.

Which adds to the difficulties of growing within the Indian market, and again highlights why increased audience reach, in pure number terms, can sometimes belie the promise of future opportunity.

Essentially, much of the growth that social apps are experiencing is coming from the Indian market, which presents potential for future business. But it’s not an immediate benefit, which makes growth a less indicative measure than it would seem.

As such, you can expect attention to shift to revenue numbers more exclusively, as the audience figures alone are largely meaningless, without the additional context of when that audience will start generating significant income for each app.

Growth is still important, especially in a longer term sense. But it is now a more distant indicator, which should bring more scrutiny as to where, exactly, each platform is seeing more downloads, and what that means for the bottom line.

While at the same time, platforms will increasingly be focusing their business development efforts on Western markets, which could present more opportunity for marketers.