DekaBank Deutsche Girozentrale lowered its stake in Axon Enterprise, Inc. (NASDAQ:AXON – Free Report) by 11.0% during the 4th quarter, HoldingsChannel.com reports. The fund owned 11,685 shares of the biotechnology company’s stock after selling 1,443 shares during the quarter. DekaBank Deutsche Girozentrale’s holdings in Axon Enterprise were worth $2,995,000 at the end of the most recent quarter.

DekaBank Deutsche Girozentrale lowered its stake in Axon Enterprise, Inc. (NASDAQ:AXON – Free Report) by 11.0% during the 4th quarter, HoldingsChannel.com reports. The fund owned 11,685 shares of the biotechnology company’s stock after selling 1,443 shares during the quarter. DekaBank Deutsche Girozentrale’s holdings in Axon Enterprise were worth $2,995,000 at the end of the most recent quarter.

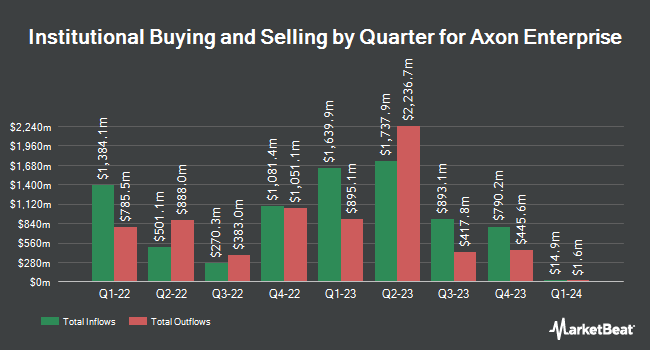

Several other large investors have also added to or reduced their stakes in the stock. BlackRock Inc. boosted its holdings in Axon Enterprise by 11.7% in the first quarter. BlackRock Inc. now owns 8,329,479 shares of the biotechnology company’s stock valued at $1,872,883,000 after acquiring an additional 870,481 shares in the last quarter. Capital International Investors lifted its position in Axon Enterprise by 605.2% during the first quarter. Capital International Investors now owns 2,660,634 shares of the biotechnology company’s stock valued at $366,449,000 after buying an additional 2,283,343 shares during the period. Sands Capital Management LLC lifted its position in Axon Enterprise by 31.1% during the third quarter. Sands Capital Management LLC now owns 2,612,305 shares of the biotechnology company’s stock valued at $519,823,000 after buying an additional 619,179 shares during the period. State Street Corp lifted its position in Axon Enterprise by 12.6% during the first quarter. State Street Corp now owns 2,377,095 shares of the biotechnology company’s stock valued at $534,484,000 after buying an additional 266,465 shares during the period. Finally, Wellington Management Group LLP lifted its position in Axon Enterprise by 3.3% during the third quarter. Wellington Management Group LLP now owns 1,956,022 shares of the biotechnology company’s stock valued at $389,229,000 after buying an additional 62,324 shares during the period. Institutional investors own 79.08% of the company’s stock.

Axon Enterprise Price Performance

Shares of NASDAQ:AXON opened at $310.81 on Friday. Axon Enterprise, Inc. has a fifty-two week low of $175.37 and a fifty-two week high of $329.87. The business has a 50-day simple moving average of $297.42 and a two-hundred day simple moving average of $254.37. The company has a debt-to-equity ratio of 0.42, a quick ratio of 2.66 and a current ratio of 3.00. The firm has a market cap of $23.45 billion, a price-to-earnings ratio of 135.14 and a beta of 0.93.

Axon Enterprise (NASDAQ:AXON – Get Free Report) last issued its earnings results on Tuesday, February 27th. The biotechnology company reported $0.77 earnings per share for the quarter, topping analysts’ consensus estimates of $0.48 by $0.29. Axon Enterprise had a return on equity of 14.11% and a net margin of 11.14%. The business had revenue of $432.14 million during the quarter, compared to analyst estimates of $418.97 million. On average, analysts expect that Axon Enterprise, Inc. will post 2.43 earnings per share for the current year.

Wall Street Analyst Weigh In

Several equities analysts have commented on AXON shares. Morgan Stanley raised their price objective on Axon Enterprise from $250.00 to $285.00 and gave the company an “equal weight” rating in a research report on Wednesday, February 28th. JMP Securities raised their price objective on Axon Enterprise from $250.00 to $285.00 and gave the company a “market outperform” rating in a research report on Tuesday, February 6th. TheStreet lowered Axon Enterprise from a “b” rating to a “c+” rating in a research report on Tuesday, February 27th. Argus initiated coverage on Axon Enterprise in a research report on Wednesday, March 13th. They issued a “buy” rating and a $380.00 price target for the company. Finally, JPMorgan Chase & Co. lifted their price target on Axon Enterprise from $330.00 to $365.00 and gave the stock an “overweight” rating in a research report on Thursday. Two investment analysts have rated the stock with a hold rating and nine have given a buy rating to the company. According to MarketBeat, the company currently has a consensus rating of “Moderate Buy” and a consensus target price of $312.64.

Check Out Our Latest Stock Analysis on Axon Enterprise

Axon Enterprise Profile

Axon Enterprise, Inc develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally. It operates through two segments, Software and Sensors, and TASER. The company also offers hardware and cloud-based software solutions that enable law enforcement to capture, securely store, manage, share, and analyze video and other digital evidence.

See Also

Want to see what other hedge funds are holding AXON? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Axon Enterprise, Inc. (NASDAQ:AXON – Free Report).

Receive News & Ratings for Axon Enterprise Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Axon Enterprise and related companies with MarketBeat.com’s FREE daily email newsletter.