Also in this letter:

■ Byju’s India CEO Arjun Mohan quits

■ US funds mark up Pine Labs valuation

■ Data centre firms seek regulatory clarity

Safety net in the works to boost local fund flows to startups

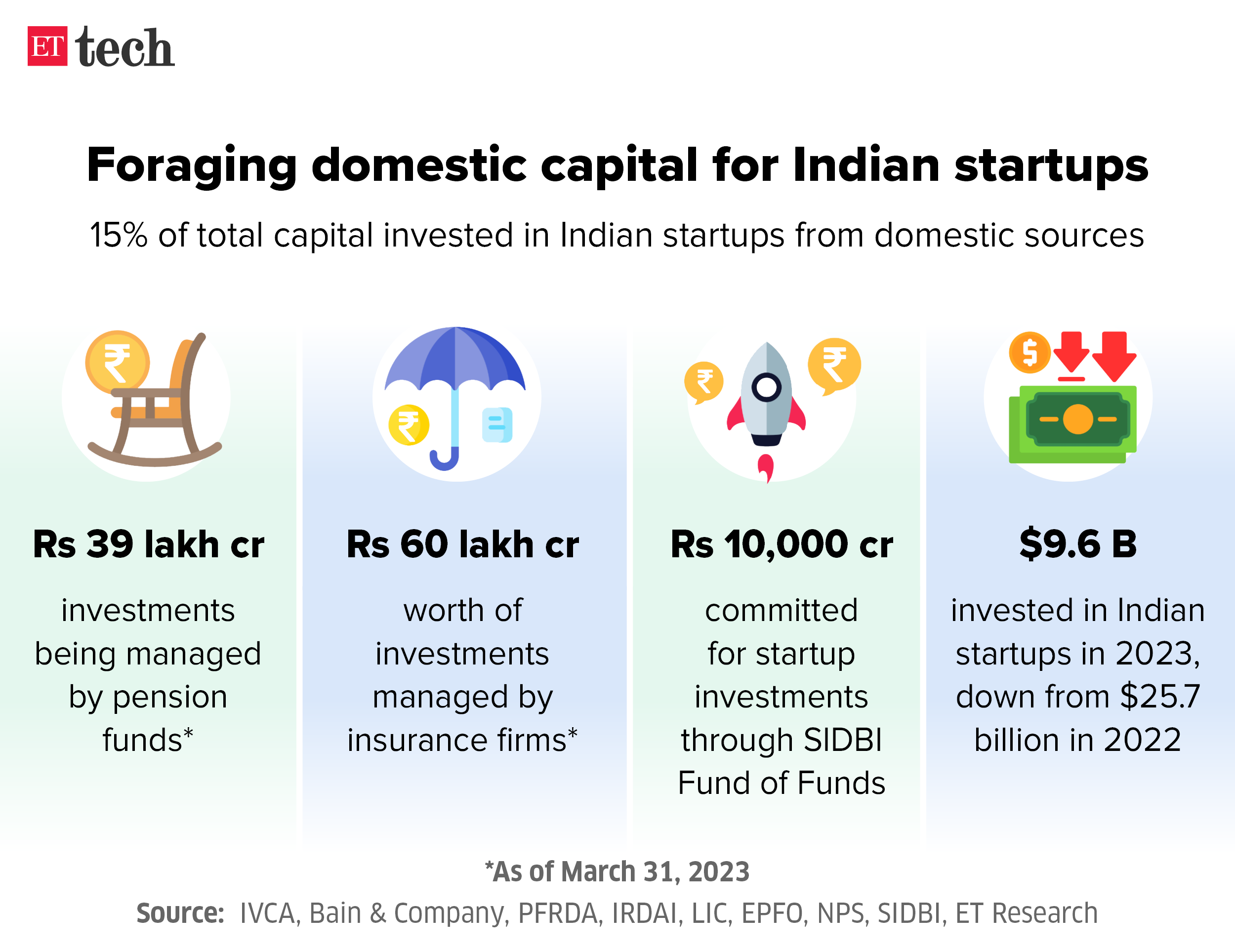

In what could potentially move the needle on enhancing domestic pools of capital in the startup ecosystem, the Indian government is preparing a framework to help minimise the risk for local pension funds and insurance companies to directly back Indian startups.

Driving the news: The Centre is working to put a safety net in place, which may allow for easing regulations and permit direct investment into startups by pension funds and insurers, which managed close to Rs 100 lakh crore of public money at the end of fiscal 2023.

Background: Around 15% of the capital invested in Indian startups is from domestic sources. While this has grown over the years, investments in the technology ecosystem in the past few years have fallen significantly.

Quote, unquote: “There are global financial institutions who are taking different risks such as currency risks and credit risks to invest into Indian startups, but Indian financial institutions are unable to do so primarily due to regulations,” said Siddarth Pai, founding partner, 3one4 Capital.

What’s the context: In an interaction with ET reporters last month, commerce and industry minister Piyush Goyal said one of the biggest concerns of the government in the context of India’s startup ecosystem was the need for higher domestic capital. “I wish to see more private sector investments from domestic funds and domestic industry…that’s my biggest area of concern in the startup ecosystem,” he said.

Apple in talks with Murugappa, Titan for assembly of camera modules

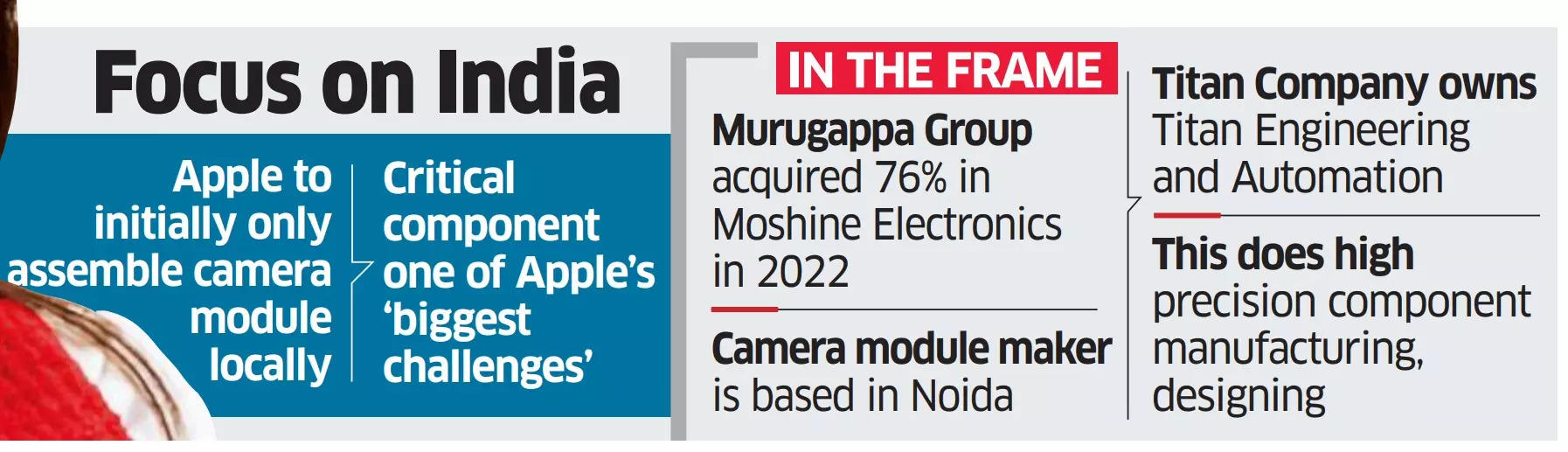

Apple is in advanced discussions with Chennai-headquartered Murugappa Group and Tata Group’s Titan Company to assemble and possibly manufacture sub-components for the camera modules used in iPhones.

Driving the news: If the talks are fruitful, it will mark a deepening of the Indian supplier ecosystem for the Cupertino- headquartered company as it shifts more of its operations away from China. Apple currently does not have Indian suppliers for the camera module embedded in its flagship phones, several models of which are now assembled in India.

“Partnering either with Titan or with the Murugappa group could address this issue,” a person aware of the matter said.

Why’s it important? Typically, image sensor chips within a camera module form the largest and most costly component of a smartphone as well as of its display. “The camera module is a critical component and currently one of the biggest challenges for Apple in India,” the person added.

Diversifying supply networks: ET reported on April 11 that Apple is looking to move at least half of its existing supply chain to India and also increase local value addition from local suppliers by almost 50% over the next three years.

Also read | Apple’s India iPhone output hits $14 billion: report

Byju’s India CEO Arjun Mohan resigns, founder Raveendran to head daily ops

Byju’s founder Byju Raveendran (left) and former India CEO Arjun Mohan

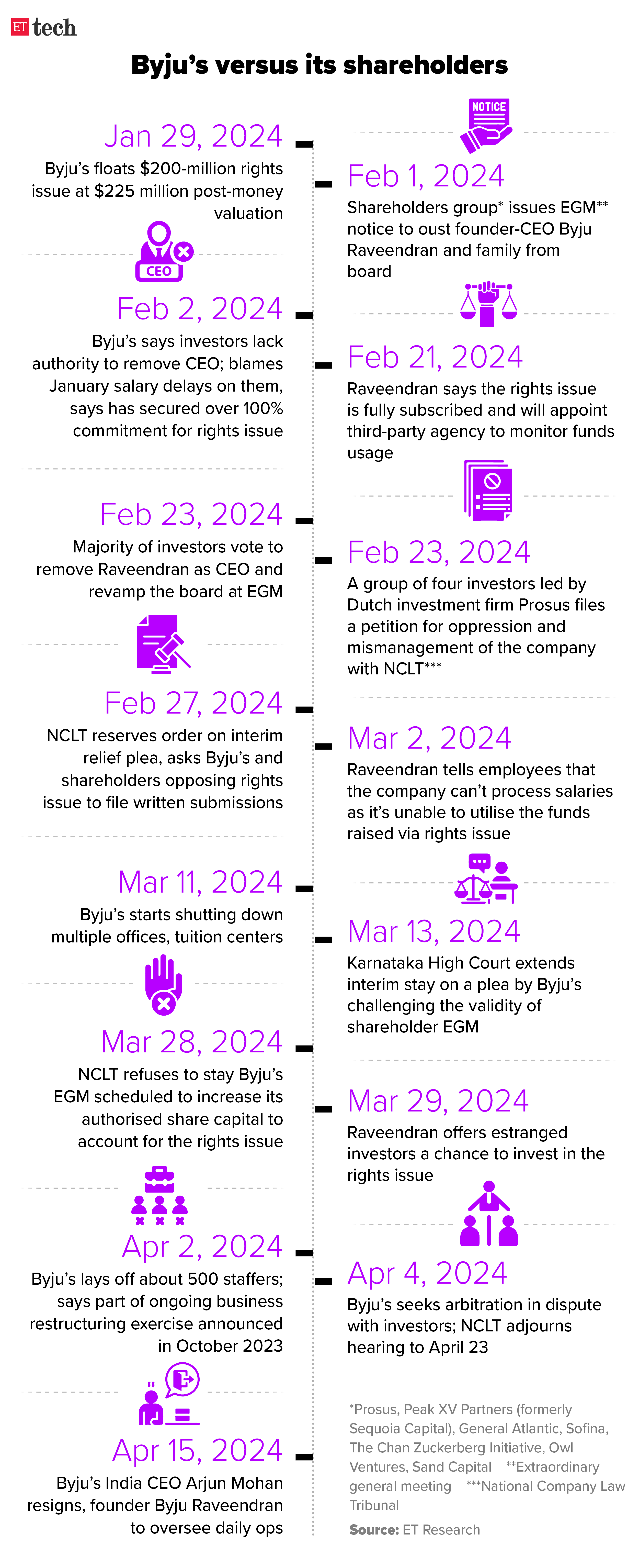

In a major top-level rejig at troubled edtech firm Byju’s, its India CEO Arjun Mohan has resigned, after just a little over six months in the job. Founder Byju Raveendran will be returning to the helm of affairs to oversee day-to-day operations. ETtech first broke the news on Monday morning, citing sources.

Driving the news: “By focusing on our core strengths with three specialised business units, we will unlock new growth opportunities while continuing to focus on profitability,” Raveendran, group CEO at Byju’s, said, adding that the restructuring will pave the way for ‘Byju’s 3.0’.

What’s the significance? Raveendran’s plan to return as operational CEO at the firm assumes significance as a group of the company’s investors voted in February, at an extraordinary general meeting (EGM), to oust him as the chief executive. The outcome of this EGM is being challenged in the Karnataka High Court and the matter is under an interim stay. Therefore, the resolutions can’t be enforced.

Byju’s troubles: The development, signalling a deepening of the crisis at the firm, comes at a time when Raveendran is grappling with multiple issues that have hit the company over the past year.

Byju’s, in a separate statement, said it received the independent scrutiniser’s report on the EGM to increase the share capital. The report said shareholders have approved the resolution with a majority 55% of the total votes polled being in favour of increasing the share capital for the rights issue.

A majority of its employees are yet to be paid salaries for the past two months, and several senior executives have left amid a severe cash crunch at the firm.

Baron hikes Pine Labs valuation to $5.8 billion, Invesco marks it up to $4.8 billion

Amrish Rau, CEO, Pine Labs

Two US-based funds have marked up their investment in merchant-focused digital payments company Pine Labs.

What’s happening: While Baron Funds hiked its valuation to $5.8 billion, Invesco has raised it to $4.8 billion as of December 2023, regulatory filings with the US Securities and Exchange Commission showed.

Baron Funds had valued Pine Labs at $5.3 billion in September last year. On January 4, ET reported that Invesco had cut the valuation of Pine Labs to $3.9 billion as of October 31.

Currently, Invesco owns around 2.8% of Pine Labs and Baron Funds has around 1.3%. Peak XV Partners, the original investor in the company, now owns about 20.6%, data from Tracxn shows.

Background: Crossover funds, which invest both in publicly traded and privately held companies, periodically review the valuation of their portfolio companies. Among various factors, revisions in valuations by investors in privately held firms often reflect the changes in their public market counterparts.

Also read | Baron Capital marks Swiggy valuation at $12.1 billion, up 13% from last fundraise

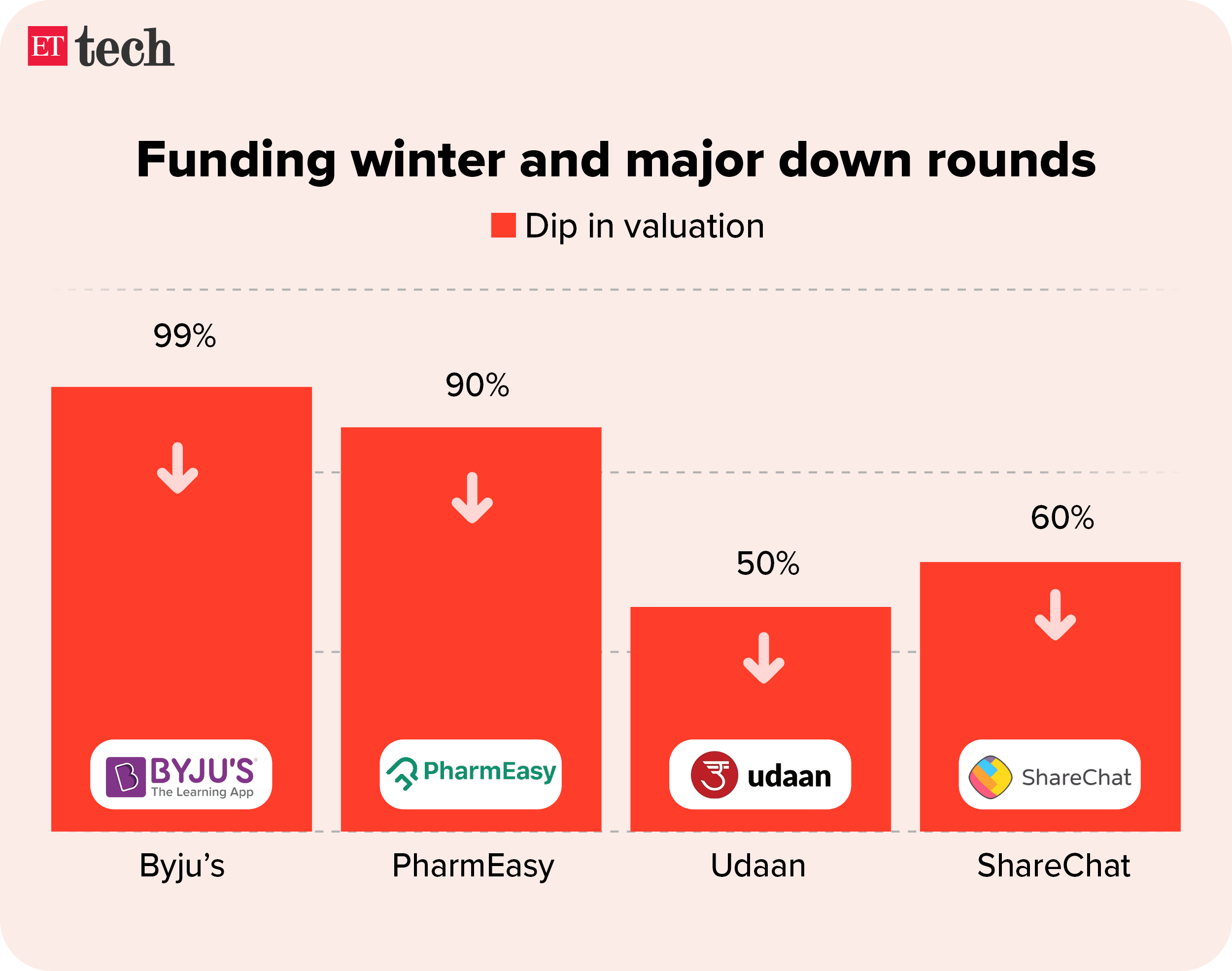

ShareChat valuation nosedives: Vernacular social media firm ShareChat’s valuation has plunged more than 60% to below $2 billion from its peak of $5 billion in 2022, said people aware of the matter.

This comes as the Twitter and Google-backed company closed a $49-million debt financing through convertible debentures from existing investors including Lightspeed, Temasek, Alkeon Capital, Moore Strategic Ventures and HarbourVest.

This is one of the steepest valuation cuts for a venture-funded startup, which has raised around $1.3 billion so far. Byju’s, PharmEasy and Udaan are among the large startups that have seen steep valuation cuts in recent months.

Other Top Stories By Our Reporters

Data centre firms seek clarity on dark fibre for captive networks: The data centre industry is calling for regulatory clarification from the government to enable the use of dark fibre for captive networks to improve the ease of doing business (EoDB) at a time when India’s data centre industry is poised for growth with increasing cloud and artificial intelligence (AI) adoption.

ETtech Done Deals

Srinivas Pallia sold all his Wipro shares before taking over as CEO: A month and a half before being appointed as the new chief executive at Wipro, Srinivas Pallia, who has been with the company for over three decades, sold all his shares worth Rs 5 crore in the public market. Pallia disposed of his one lakh Wipro shares through “market sale” on February 14 this year and the transaction was reported to the exchange on February 15.

Global Picks We Are Reading

■ The Next Frontier for Brain Implants Is Artificial Vision (Wired)

■ AI keeps going wrong. What if it can’t be fixed? (FT)

■ Generative AI Is Changing the Hiring Calculus at These Companies (WSJ)