Understanding the intricacies of VeChain’s price trends is crucial for making informed investment decisions. In this article, we delve into the art of predicting VeChain’s price movements and explore the tools and strategies that can help investors navigate this dynamic market. Just as we analyze VeChain’s price trends, platforms like quantumtradewave.com can help Bitcoin traders make informed decisions with their automated bot.

Predicting VeChain Price Trends

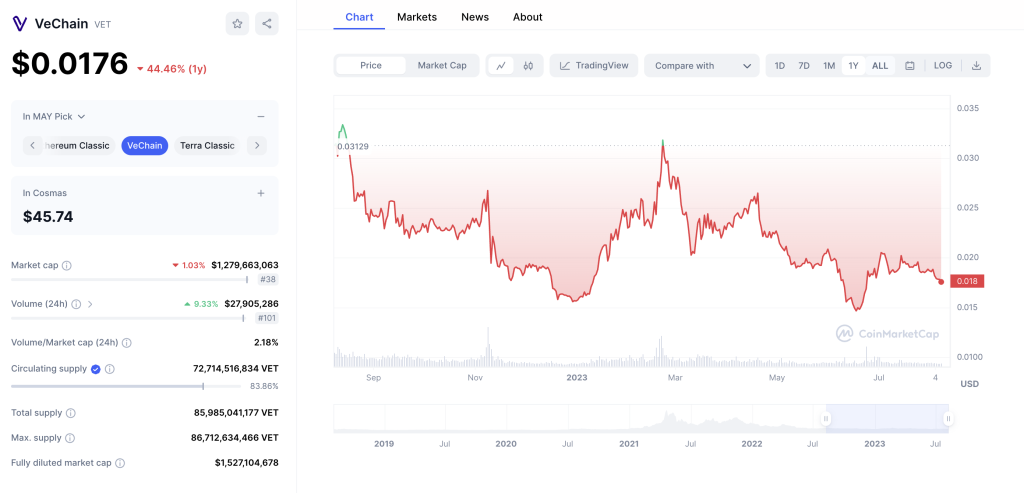

Predicting the price trends of VeChain requires a comprehensive analysis of various factors that influence its value. One crucial aspect is the examination of historical data, which provides insights into past price movements and patterns. By studying the price fluctuations over time, investors can identify recurring trends and patterns that may offer clues about future price movements.

Technical indicators play a significant role in predicting VeChain price trends. Moving averages, for instance, help smooth out short-term price fluctuations and provide a clearer picture of the overall trend. By calculating the average price over a specific time period, such as 50 or 200 days, investors can identify potential support and resistance levels.

Another important technical indicator is the Relative Strength Index (RSI), which measures the magnitude and speed of price changes. RSI values above 70 indicate an overbought condition, suggesting a potential price correction, while values below 30 indicate an oversold condition, signaling a possible price rebound.

Bollinger Bands are also useful in predicting VeChain price trends. These bands consist of a moving average line and upper and lower bands that represent standard deviations. When the price moves close to the upper band, it suggests overbought conditions, while prices nearing the lower band indicate oversold conditions. Traders often look for price breakouts from the bands as potential signals of future price movements.

In addition to technical analysis, fundamental factors should not be overlooked. Evaluating VeChain’s partnerships and adoption by businesses and industries can provide insights into the potential future demand for VeChain tokens. Increased partnerships and integrations may indicate a growing ecosystem, which could positively impact the price.

Considering the broader cryptocurrency market is also crucial. VeChain’s price can be influenced by market sentiment, overall market trends, and regulatory developments. Staying informed about industry news and monitoring market conditions can help investors anticipate potential price movements.

Strategies for Informed VeChain Investments

One crucial aspect is to determine the investment horizon and align it with the investor’s goals and risk tolerance. VeChain offers both short-term and long-term investment opportunities, each with its own considerations. Short-term traders may focus on taking advantage of price volatility and short-lived trends, while long-term investors may aim to capitalize on VeChain’s growth potential over an extended period.

Risk management is another key strategy for VeChain investments. Diversification plays a vital role in mitigating risk by spreading investments across different assets or sectors. By diversifying their VeChain portfolio with other cryptocurrencies or even traditional investments, investors can reduce the impact of adverse price movements on their overall portfolio.

Staying informed about VeChain’s ecosystem and developments is crucial for making informed investment decisions. Regularly monitoring VeChain’s partnerships, collaborations, and technological advancements can provide insights into the project’s progress and potential future value. Following VeChain’s official announcements and engaging with the VeChain community can also help investors stay up to date with the latest news and trends.

Setting realistic investment goals and expectations is paramount. Investors should avoid falling prey to unrealistic promises or overly optimistic projections. Instead, they should conduct thorough research, analyze historical data, and consider expert opinions to set achievable targets. Having a clear investment plan and adhering to it can prevent impulsive decisions driven by market emotions.

Technical analysis tools, such as moving averages, support and resistance levels, and oscillators, can aid in identifying optimal entry and exit points. By combining technical analysis with fundamental research, investors can develop a more comprehensive understanding of VeChain’s potential price movements.

It’s also important to keep an eye on regulatory developments and market trends that may impact VeChain and the broader cryptocurrency market. Regulatory changes, government interventions, or shifts in investor sentiment can influence the price and market dynamics. Staying informed about these external factors can help investors anticipate potential risks and opportunities.

Conclusion

In the dynamic world of VeChain investment, predicting price trends is a complex task. By combining technical analysis, fundamental research, and strategic decision-making, investors can gain valuable insights for informed investment decisions. However, it’s important to remember that the cryptocurrency market is volatile, and risks are inherent. A well-informed approach, based on thorough analysis and prudent risk management, can increase the chances of success in VeChain investments.