SG Americas Securities LLC acquired a new stake in Hewlett Packard Enterprise (NYSE:HPE – Free Report) in the 4th quarter, Holdings Channel.com reports. The firm acquired 30,152 shares of the technology company’s stock, valued at approximately $512,000.

SG Americas Securities LLC acquired a new stake in Hewlett Packard Enterprise (NYSE:HPE – Free Report) in the 4th quarter, Holdings Channel.com reports. The firm acquired 30,152 shares of the technology company’s stock, valued at approximately $512,000.

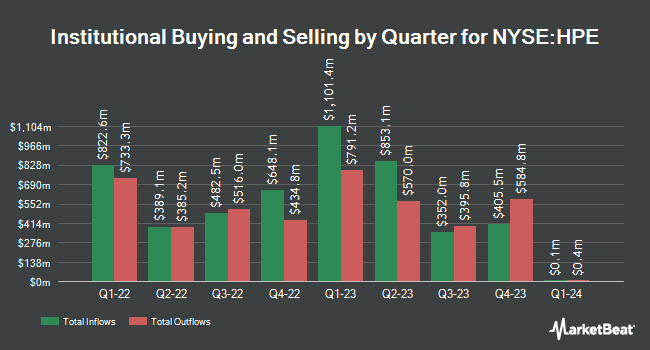

Other institutional investors have also recently added to or reduced their stakes in the company. Marshall Wace LLP lifted its position in shares of Hewlett Packard Enterprise by 1,591.9% during the 2nd quarter. Marshall Wace LLP now owns 4,939,064 shares of the technology company’s stock valued at $82,976,000 after acquiring an additional 4,647,141 shares during the period. Two Sigma Advisers LP raised its stake in shares of Hewlett Packard Enterprise by 302.9% during the 1st quarter. Two Sigma Advisers LP now owns 4,865,700 shares of the technology company’s stock worth $77,511,000 after buying an additional 3,658,100 shares during the last quarter. Hawk Ridge Capital Management LP boosted its position in shares of Hewlett Packard Enterprise by 152.4% in the 2nd quarter. Hawk Ridge Capital Management LP now owns 5,979,631 shares of the technology company’s stock worth $100,458,000 after buying an additional 3,610,364 shares in the last quarter. Deutsche Bank AG grew its stake in Hewlett Packard Enterprise by 47.8% in the 1st quarter. Deutsche Bank AG now owns 9,574,800 shares of the technology company’s stock valued at $152,527,000 after acquiring an additional 3,097,741 shares during the last quarter. Finally, Renaissance Technologies LLC raised its position in shares of Hewlett Packard Enterprise by 193.2% during the 1st quarter. Renaissance Technologies LLC now owns 4,273,700 shares of the technology company’s stock worth $68,080,000 after purchasing an additional 2,816,100 shares during the last quarter. Hedge funds and other institutional investors own 80.78% of the company’s stock.

Hewlett Packard Enterprise Trading Up 0.3 %

Shares of HPE opened at $18.00 on Friday. The company has a current ratio of 0.89, a quick ratio of 0.63 and a debt-to-equity ratio of 0.37. The firm has a market capitalization of $23.40 billion, a P/E ratio of 12.41, a price-to-earnings-growth ratio of 3.37 and a beta of 1.21. The stock’s fifty day simple moving average is $16.42 and its 200 day simple moving average is $16.38. Hewlett Packard Enterprise has a twelve month low of $13.65 and a twelve month high of $20.07.

Hewlett Packard Enterprise (NYSE:HPE – Get Free Report) last announced its quarterly earnings results on Thursday, February 29th. The technology company reported $0.48 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.45 by $0.03. Hewlett Packard Enterprise had a return on equity of 9.12% and a net margin of 6.81%. The firm had revenue of $6.76 billion during the quarter, compared to the consensus estimate of $7.09 billion. During the same period in the prior year, the firm earned $0.38 EPS. The firm’s quarterly revenue was down 13.5% compared to the same quarter last year. On average, equities research analysts forecast that Hewlett Packard Enterprise will post 1.4 earnings per share for the current year.

Hewlett Packard Enterprise Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, April 12th. Investors of record on Friday, March 15th will be issued a $0.13 dividend. The ex-dividend date of this dividend is Thursday, March 14th. This represents a $0.52 annualized dividend and a yield of 2.89%. Hewlett Packard Enterprise’s dividend payout ratio is currently 35.86%.

Wall Street Analyst Weigh In

A number of analysts recently commented on HPE shares. Evercore ISI dropped their price objective on Hewlett Packard Enterprise from $19.00 to $18.00 and set an “in-line” rating for the company in a research report on Friday, March 1st. Barclays cut their price target on Hewlett Packard Enterprise from $15.00 to $14.00 and set an “equal weight” rating for the company in a report on Friday, March 1st. StockNews.com upgraded Hewlett Packard Enterprise from a “hold” rating to a “buy” rating in a research note on Wednesday. Wells Fargo & Company reaffirmed an “equal weight” rating and set a $17.00 price objective (down previously from $21.00) on shares of Hewlett Packard Enterprise in a research note on Friday, March 1st. Finally, Sanford C. Bernstein lowered shares of Hewlett Packard Enterprise from an “outperform” rating to a “market perform” rating and dropped their price target for the stock from $20.00 to $17.00 in a research report on Tuesday, January 16th. Seven equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company’s stock. Based on data from MarketBeat.com, Hewlett Packard Enterprise currently has an average rating of “Hold” and an average price target of $17.45.

Get Our Latest Analysis on HPE

About Hewlett Packard Enterprise

Hewlett Packard Enterprise Company provides solutions that allow customers to capture, analyze, and act upon data seamlessly in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan. It operates in six segments: Compute, HPC & AI, Storage, Intelligent Edge, Financial Services, and Corporate Investments and Other.

See Also

Want to see what other hedge funds are holding HPE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Hewlett Packard Enterprise (NYSE:HPE – Free Report).

Receive News & Ratings for Hewlett Packard Enterprise Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Hewlett Packard Enterprise and related companies with MarketBeat.com’s FREE daily email newsletter.